Why Is September a Bad Month for Stocks?

Every year, as the calendar flips from summer into fall, investors brace themselves for the same question: Why is September a bad month for stocks?

It’s not just an old Wall Street saying — it’s a pattern etched into decades of market history.

September is the one month that consistently delivers more losses than gains. Traders groan about it. Analysts warn about it.

And retail investors either panic or sit on their hands, waiting for the storm to pass.

But this year, September might have a surprise in store…

The Historical Record of September

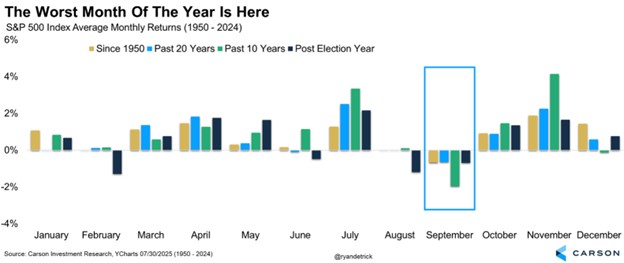

From 1950 through 2020, the S&P 500 averaged a 0.4% decline in September.

That’s not a catastrophic crash, but it’s a consistent drag compared with July’s average gain of 1.6% or December’s Santa Claus rally of nearly 1.5%…

Even during roaring bull markets — like the dot-com run in the late 1990s or the post-crisis surge of the 2010s — September still found ways to cool momentum.

And when September does go bad, it goes really bad…

Think 2008, when Lehman Brothers collapsed mid-September and triggered the global financial crisis.

Or 2001, when September brought both recession and a terrorist attack that sent markets reeling.

So if you’re asking, “Why is September a bad month for stocks?” — part of the answer is “history itself”…

Why September Trips up Markets

So what exactly makes September such a thorn in investors’ sides? It’s not like there’s something in the autumn air that makes markets dive.

Instead, it’s a cocktail of forces — some structural, some psychological — that converge around this time of year.

One big factor is seasonality…

The summer months are notoriously low-volume as traders and fund managers head for vacation.

By the time September rolls around, everyone comes back to their desks, reviews portfolios, and often decides it’s time to trim risk.

Suddenly, sell orders stack up like planes circling LaGuardia, and the market can’t absorb them all without dipping.

Another culprit is fiscal year timing…

The Best Free Investment You’ll Ever Make

Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “How to Make Your Fortune in Stocks”

It contains full details on why dividends are an amazing tool for growing your wealth.

Many mutual funds and institutions operate on fiscal calendars that close at the end of September.

That means portfolio managers are pressured to lock in gains, harvest tax losses, and present a “clean” book for clients.

The result? A wave of selling that isn’t about fundamentals, just optics.

Then there’s the economic rhythm…

Consumer spending tends to dip after the summer vacation season, and businesses often guide cautiously as they look toward the following year.

Investors don’t like uncertainty, and when corporate executives start sounding cautious, Wall Street listens.

Finally, let’s not forget the self-fulfilling prophecy…

Markets are driven by psychology as much as math, and when everyone expects September to be weak, that expectation alone can push people to sell.

It’s like a financial superstition that feeds on itself.

That’s why even in boom years, September still finds a way to drag. It’s not one bad apple in the basket — it’s the whole seasonal system working against the market.

The Bearish Case for This September

And for those of you who think history is destiny, the bearish case for September 2025 looks plenty convincing.

Start with geopolitics…

Conflicts in Eastern Europe remain unresolved, tensions in the Middle East simmer, and the South China Sea is a constant flash point. Global investors are already jittery about how any of these hot spots could flare up, and September is a perfect excuse to de-risk.

Then there’s the issue of interest rates…

While inflation has come down from its 2022 peaks, it’s not exactly gone. If prices stay sticky, the Federal Reserve could delay rate cuts — or worse, hint at one last hike.

Even a whiff of tighter policy has the power to spook equity markets, especially growth names that thrive on cheap capital.

Don’t forget earnings season…

We’ve seen plenty of companies ride the AI hype wave, promising revolutionary growth without showing profits to back it up.

September could be when reality sets in, and Wall Street starts punishing firms that overpromised.

Layer on political risk…

Washington is barreling toward budget fights, debt ceiling debates, and election-year chaos. Investors hate uncertainty, and U.S. politics offer an unlimited supply of it.

Historically, September is when these fiscal showdowns heat up, adding yet another reason for markets to wobble.

In other words, if you want to argue that September 2025 will follow the same old script, the case practically writes itself.

Why This September Could Buck the Trend

But here’s the thing: Markets don’t live in the past. They live in the present and predict the future.

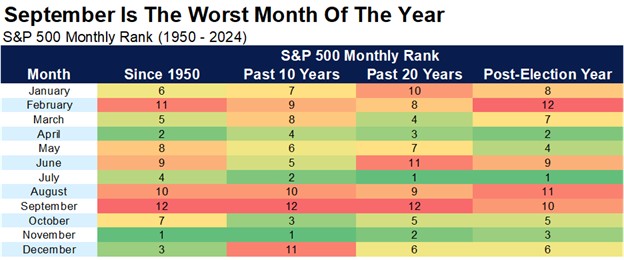

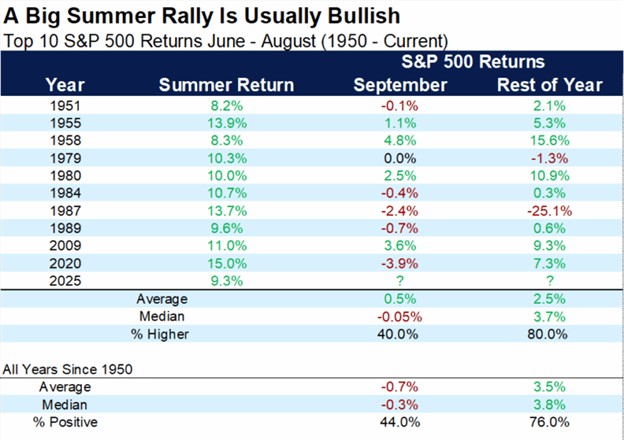

And, as Carson Group's Ryan Detrick suggests with the following table, the present offers some pretty good reasons why the immediate future might not be as grim as history suggests that it could be.

But it's more than just the technical signals lining up…

First, inflation has cooled. It’s not back to pre-pandemic levels, but it’s well below the panic-inducing highs of 2022.

That means the Fed is closer to easing than tightening.

Even if cuts don’t come immediately, the pressure has shifted from “How high will rates go?” to “How soon will they come down?” That’s a major relief for markets.

Second, the labor market, despite showing recent signs of weakness, is still strong.

Unemployment is still hovering near historic lows, wages are still growing, and consumer spending hasn’t completely fallen off a cliff.

People might complain about prices, but they’re still swiping their cards. That resilience props up the broader economy and, by extension, corporate earnings.

Third, the AI boom is real.

Whether you’re bullish or skeptical, the fact is that data centers, chipmakers, and energy companies tied to AI infrastructure are growing at breakneck speed.

Unlike past hype cycles — say, dot-coms in the late ’90s — this one is backed by real demand. Every company wants AI capability, and they’re willing to spend billions to get it.

And then there’s commodities…

Gold and silver are hot again, thanks to central banks hoarding reserves and institutional investors hedging against uncertainty.

Unlike in 2008, when the flight to safety was all about cash, today it’s about hard assets.

That provides a floor for commodity producers and a hedge for investors wary of a downturn.

In short, while the September effect looms large in the rearview mirror, the road ahead looks sturdier than in many of the years when the month lived up to its reputation.

The Bottom Line: Fear Is More Expensive Than Crashes

Here’s the real answer to the question, "Why is September a bad month for stocks?"…

Because fear makes people sell too soon, sit out too long, or miss the upside that comes next.

More money has been lost waiting for a better entry point than in all the market crashes combined.

So if you’re worried about a collapse, hedge with gold, silver, and the miners pulling those metals out of the ground.

And if you believe the bull market continues, ride the AI wave — own the accelerators, the data centers, and the energy providers that will keep this revolution running.

Either way, sitting on the sidelines is the one guaranteed way to lose.

Stay Bold, Stay Invested, and Stay with Us

The stock market doesn’t move on the calendar — it moves on conviction, innovation, and capital. September might have a bad reputation, but reputations can change.

So stay bold while others are fearful. Buy the dips others are sure will end in disaster.

And keep coming back to Wealth Daily to stay ahead of the trends that are moving markets and minting fortunes.

And if you’re ready to put conviction into action right now, we’ve put together a free video highlighting four stocks poised for outperformance this September.

Don’t miss it — this could be the month you finally stop fearing the market and start profiting from it.

To your wealth,

Jason Williams

After graduating Cum Laude in finance and economics, Jason designed and analyzed complex projects for the U.S. Army. He made the jump to the private sector as an investment banking analyst at Morgan Stanley, where he eventually led his own team responsible for billions of dollars in daily trading. Jason left Wall Street to found his own investment office and now shares the strategies he used and the network he built with you. Jason is the founder of Main Street Ventures, a pre-IPO investment newsletter; the founder of Future Giants, a nano cap investing service; and authors The Wealth Advisory income stock newsletter. He is also the managing editor of Wealth Daily. To learn more about Jason, click here.

Want to hear more from Jason? Sign up to receive emails directly from him ranging from market commentaries to opportunities that he has his eye on.

The Best Free Investment You'll Ever Make

We never spam! View our Privacy Policy

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.

@TheReal_JayDubs

@TheReal_JayDubs Angel Research on Youtube

Angel Research on Youtube